Asian Life Insurance Company Limited (ALICL) established under the Company Act 2053 on 27th February, 2008 (Falgun 15, 2064) and started functioning on 3rd April, 2008 (Chaitra 21, 2064).

The Authorized Capital of the Company is Rs. 5 billion with Rs. 2.9 billion paid up capital. (60 percent promoter and 40 percent public share.) ALICL has a Life Funds of Rs. 34 billion (Paush end 2079-80).

There are 93 promoters of the company: 2 institutional and the remaining 91 individual promoters. Among the institutional promoters, there are prominent BFIs and Corporate House.

Dinesh Lal Shrestha CEO

It is with great pride and gratitude that I share with you the journey of our Asian Life Insurance Company, spanning over 15 years. When we began our operations in the year 2008, our goal was to provide the best life insurance solutions to our customers.

Over the years, we have strived to build a strong foundation based on trust, integrity, and transparency. Our unwavering commitment towards our customers has helped us win their trust and loyalty, making us one of the leading life insurers in this industry today.

As we move into the next phase of our journey, we have prioritized diversification of our investments in sectors of national priority. We believe this will not only benefit our policyholders, shareholders and workforce but also contribute to the development of the country's economy.

Looking ahead, we are focused on digital transformation for better customer experience, accelerating the execution of our growth strategy while continuing to build on the financial strength. I am incredibly excited about this journey and truly believe the best of our business is yet to come. Once again, thank you for your continued support, and we look forward to your continued patronage as we embark on new opportunities in the future.

With a vast network of branches, countless policies issued, and substantial premiums generated, Asian Life Insurance sets the benchmark for industry excellence with a vast network of branches.

Agency

Branch

Policy Holder

Life Funds

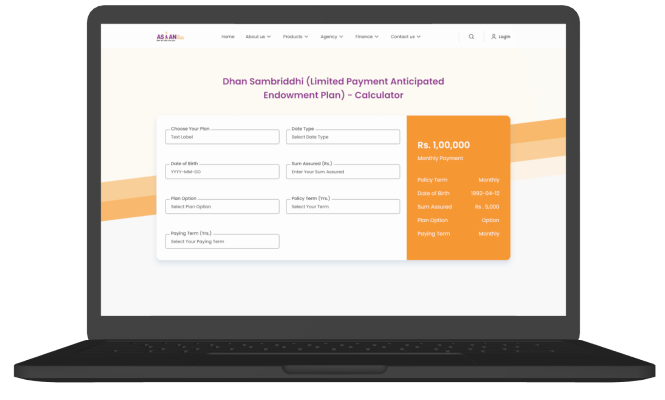

Getting an online policy with Asian Life Insurance is a breeze: visit us online, choose your plan, view the premium, and conveniently pay to secure your coverage.

Online convenience at your fingertips

Tailor your coverage with the perfect plan

Transparently assess your premium

Effortlessly settle your premium payment